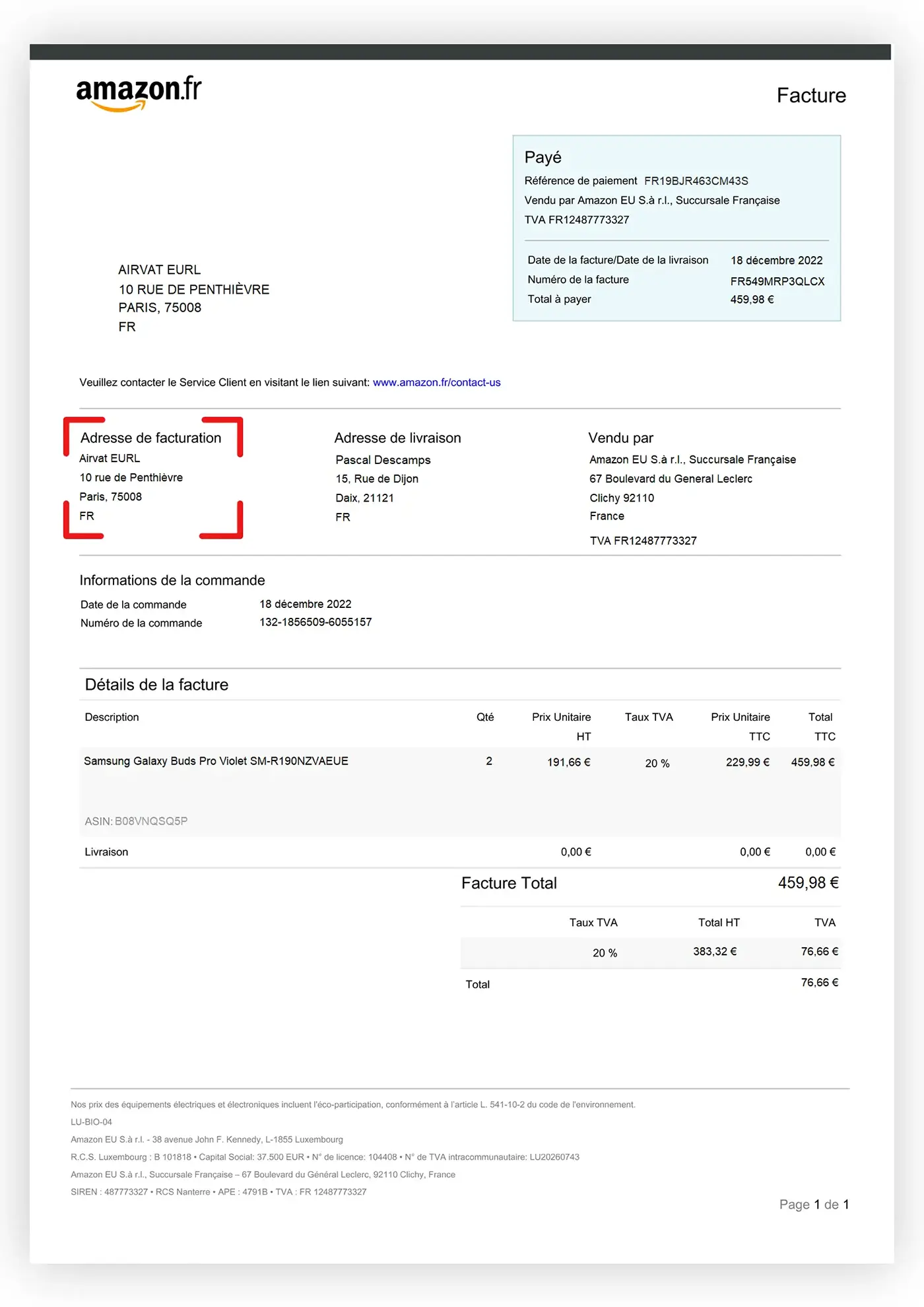

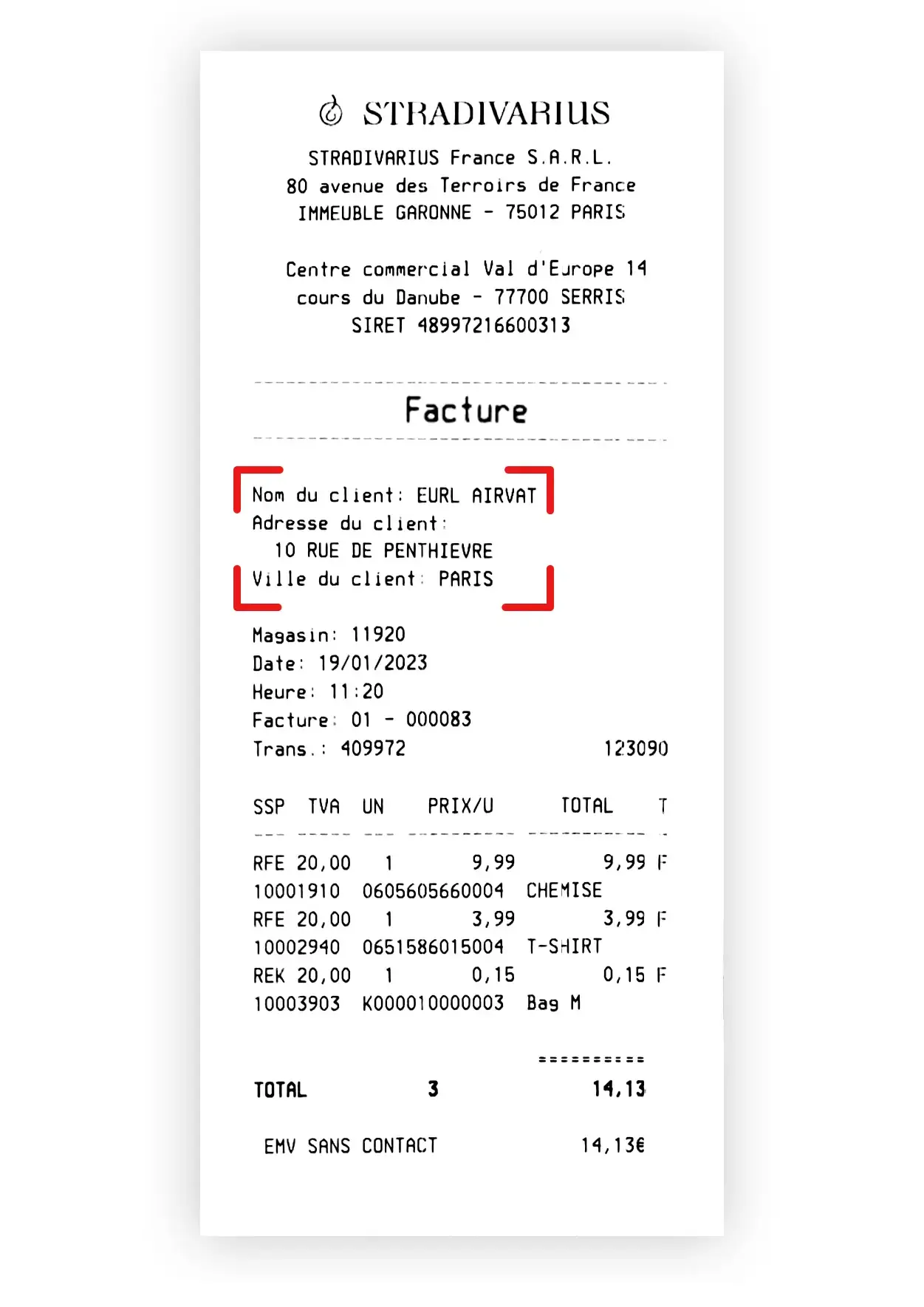

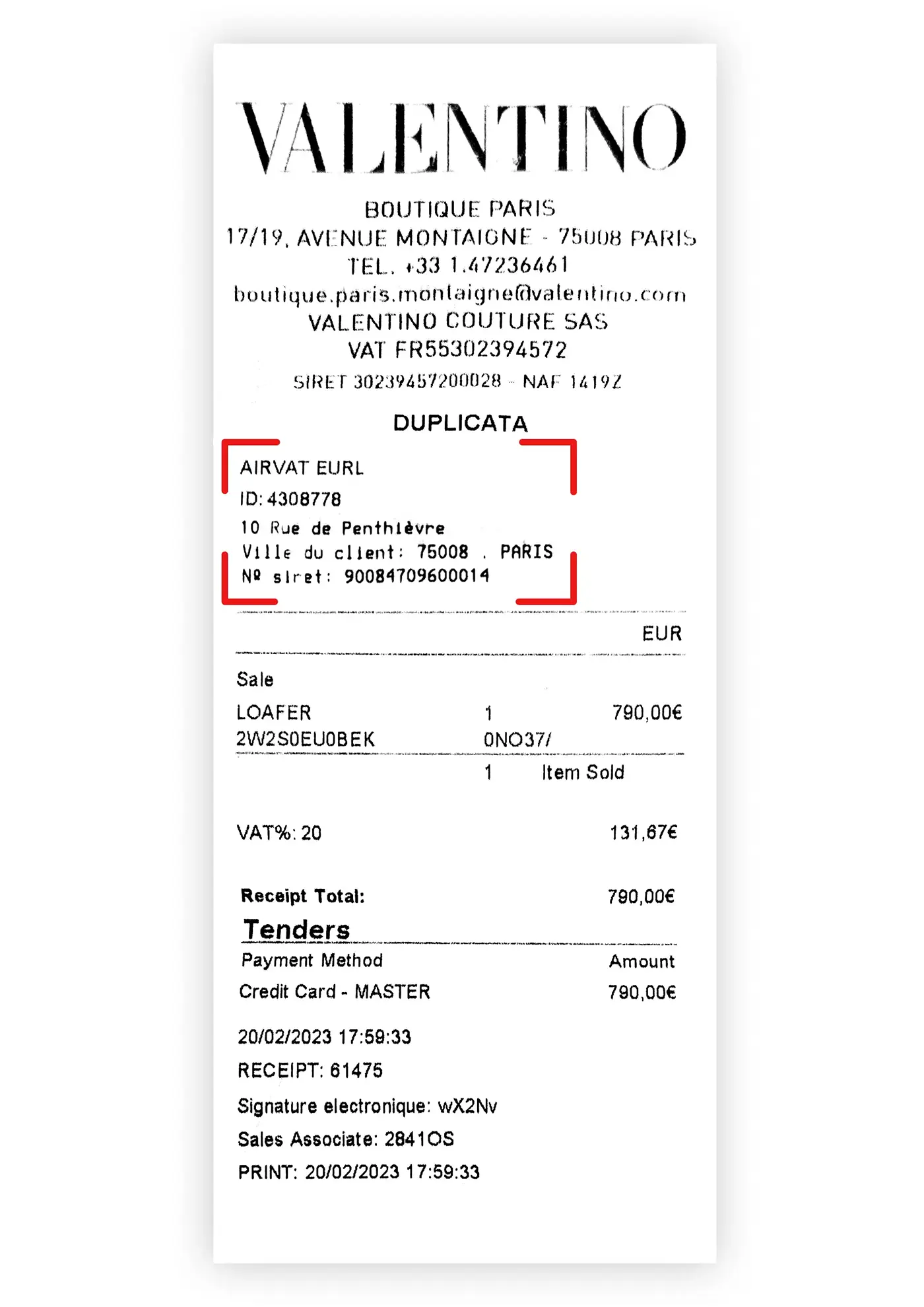

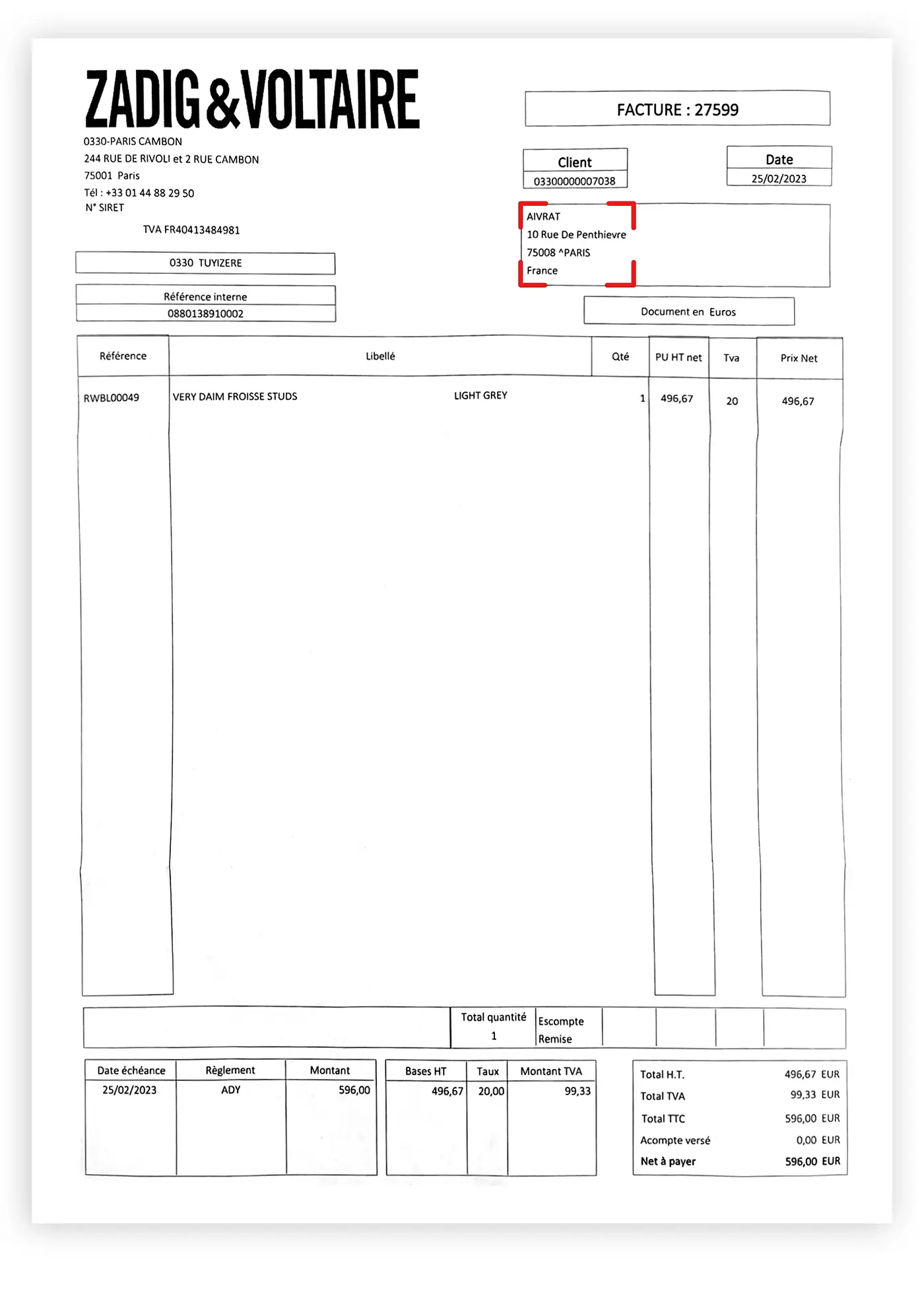

Invoices in the name of Airvat

27/02/2023

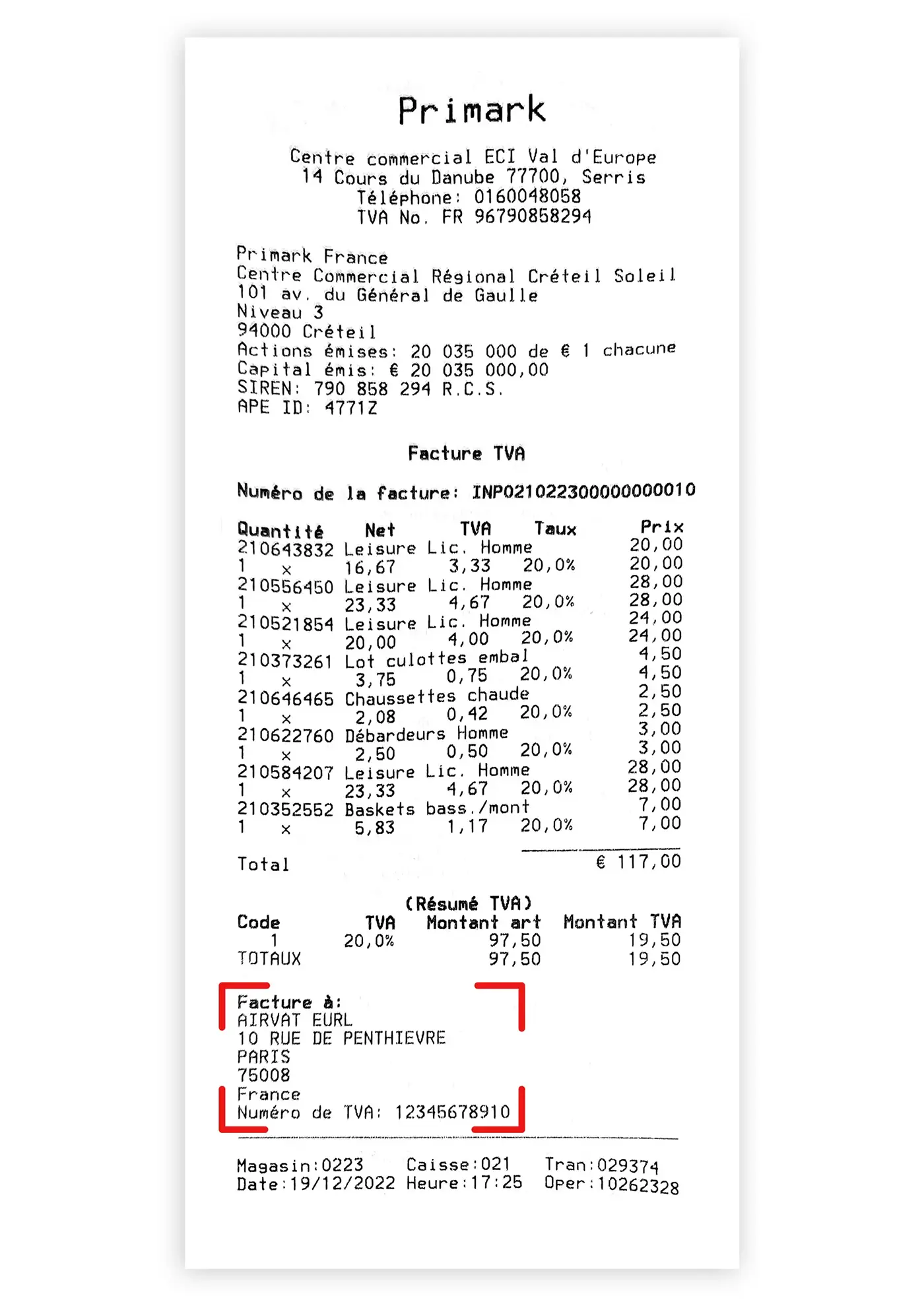

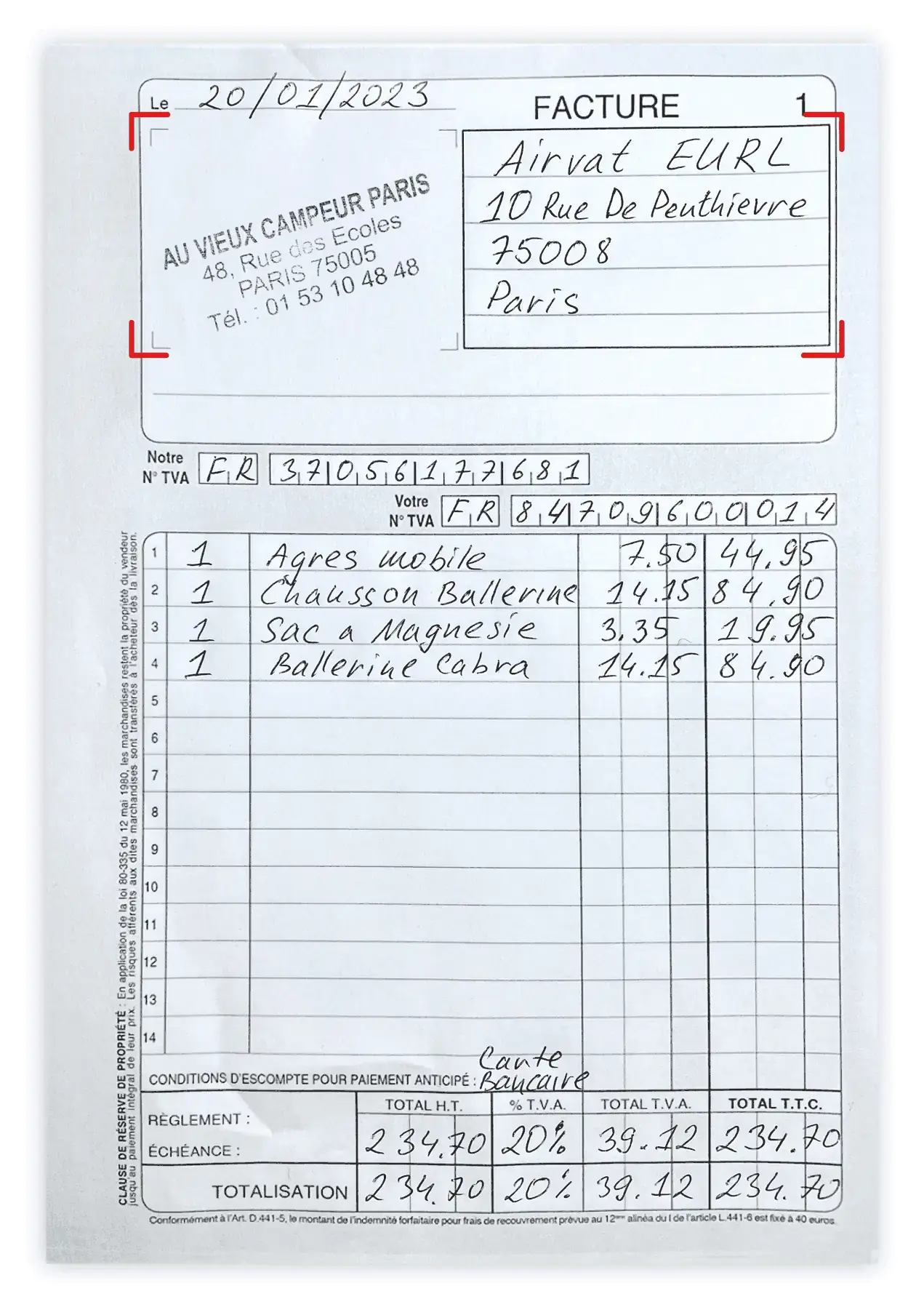

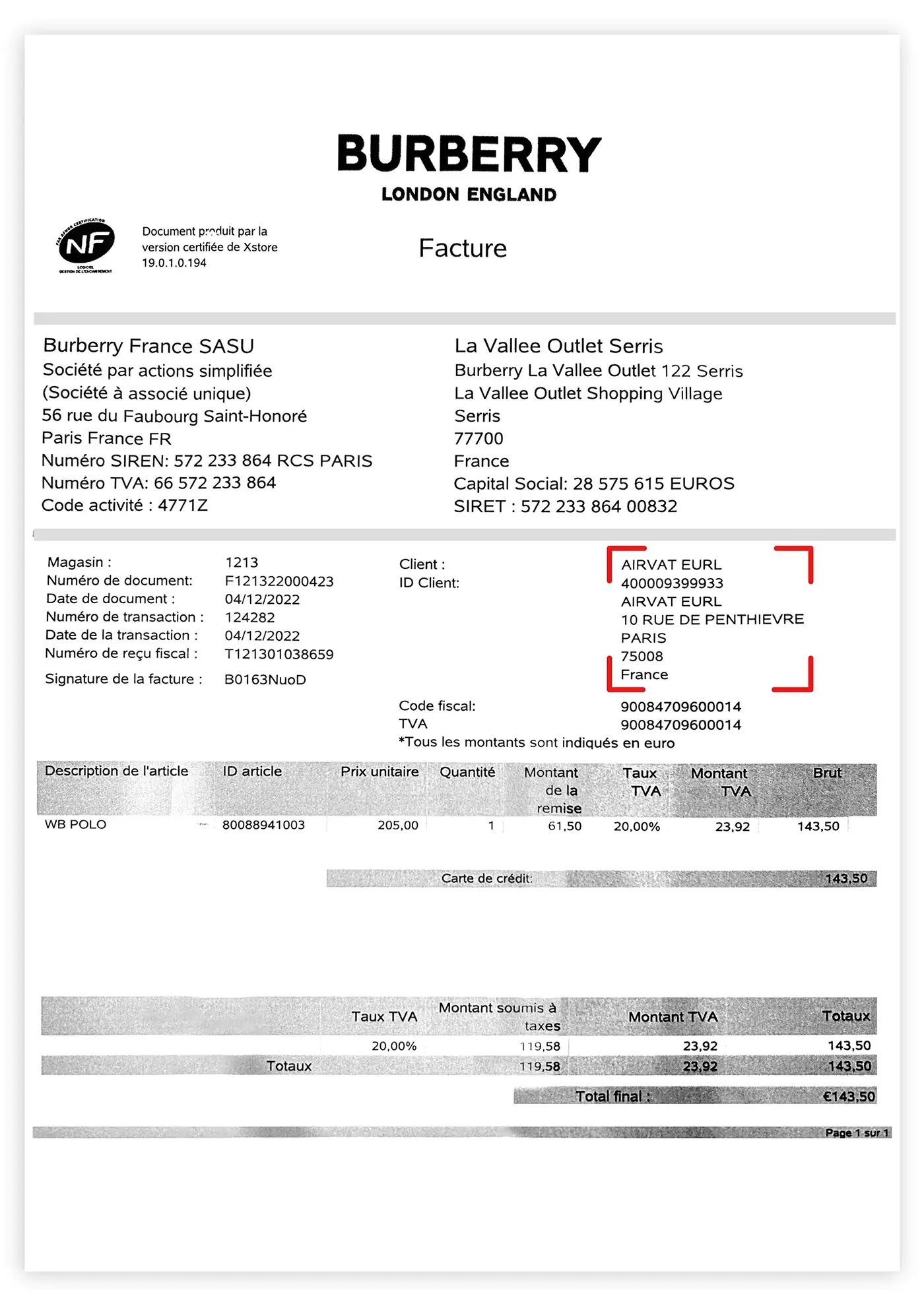

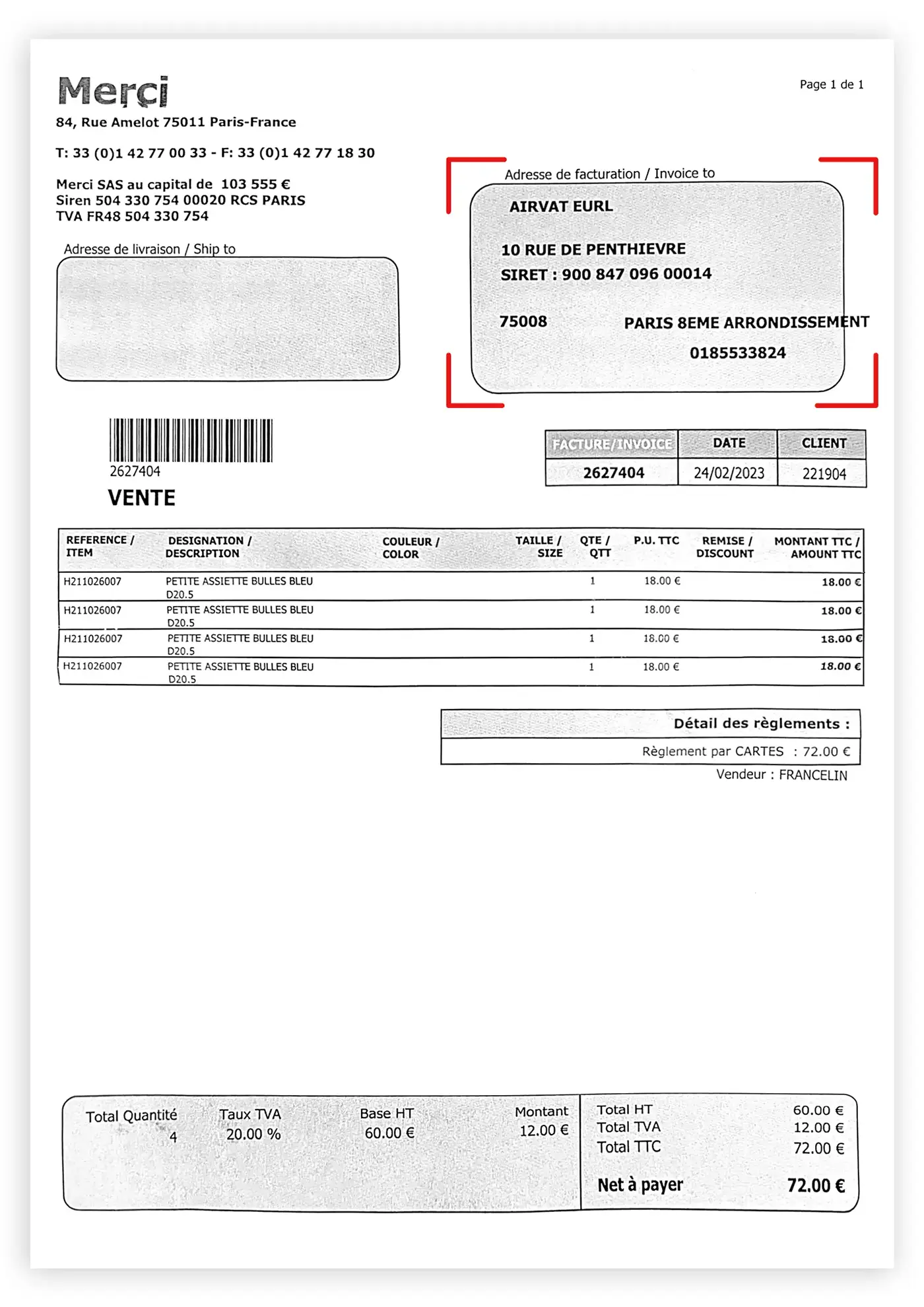

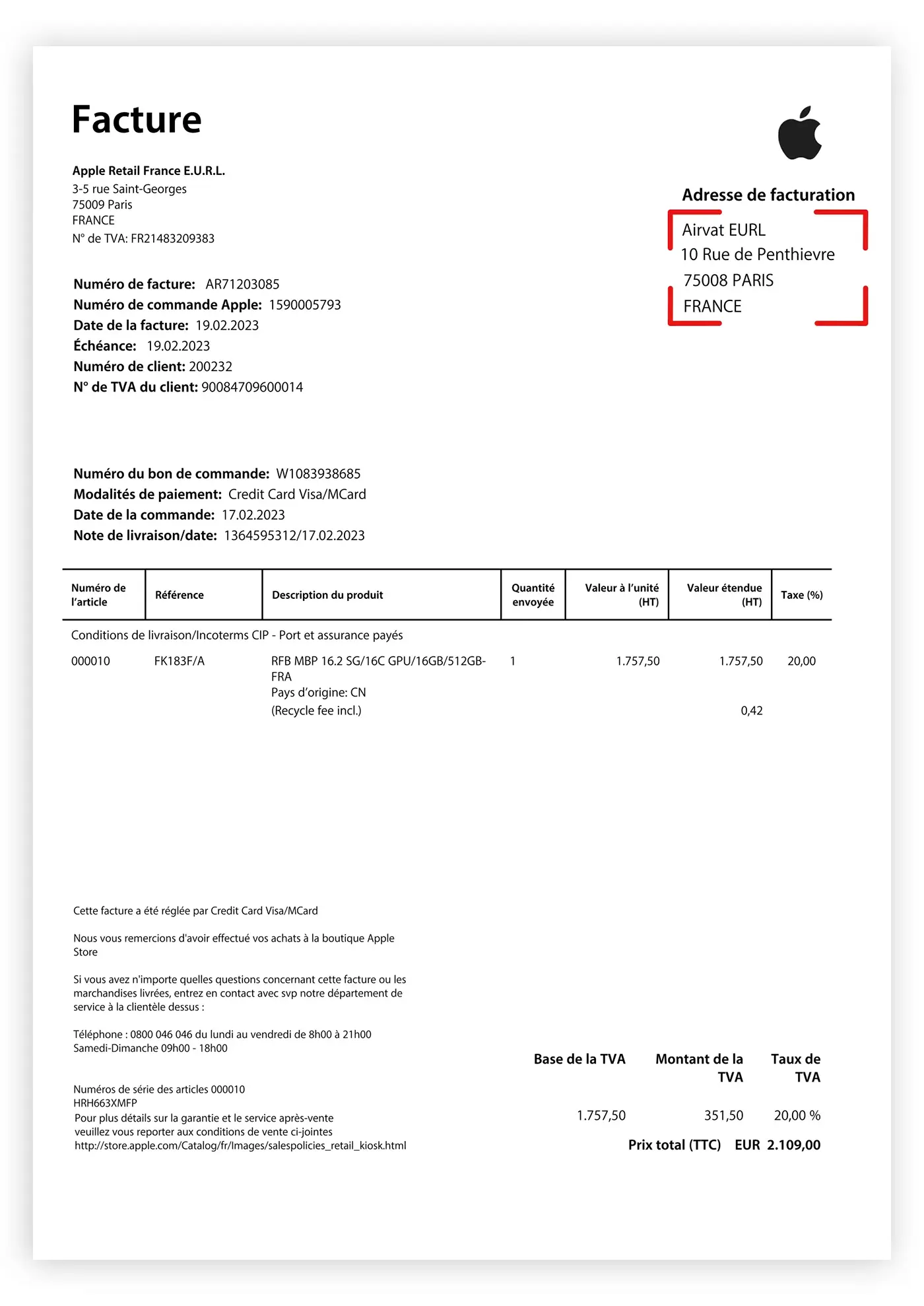

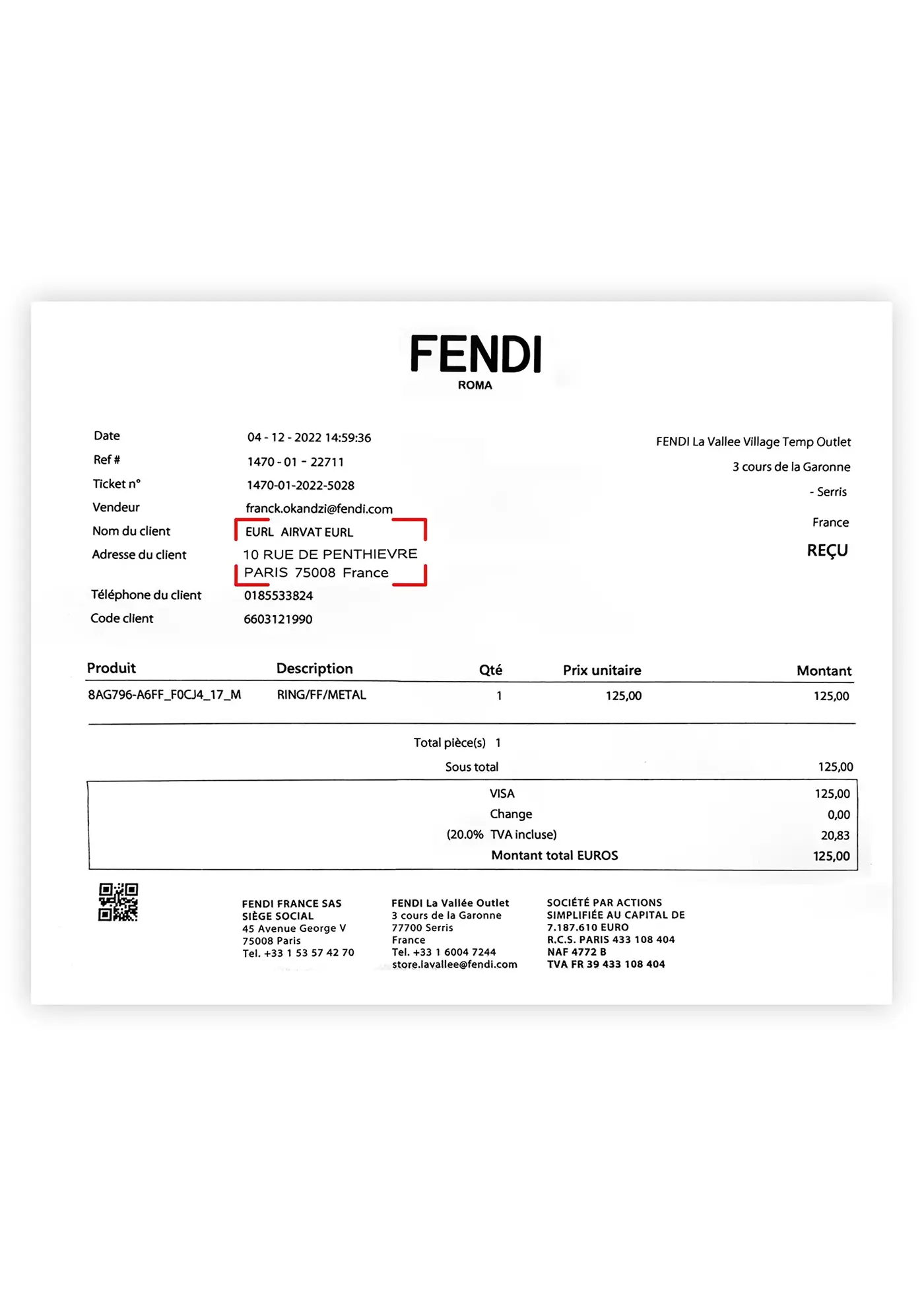

For each purchase you must specifically request the store to issue a business invoice (or “facture” in French) addressed to Airvat.

Don’t mention anything about “VAT refund” or “tax-free” to the shop assistant to avoid confusion. Instead, simply ask “Please could I have an invoice / facture?” and insist on getting one.

In the app you will find a handy instructions screen to show to the sales assistant to help communicate the required invoice information.

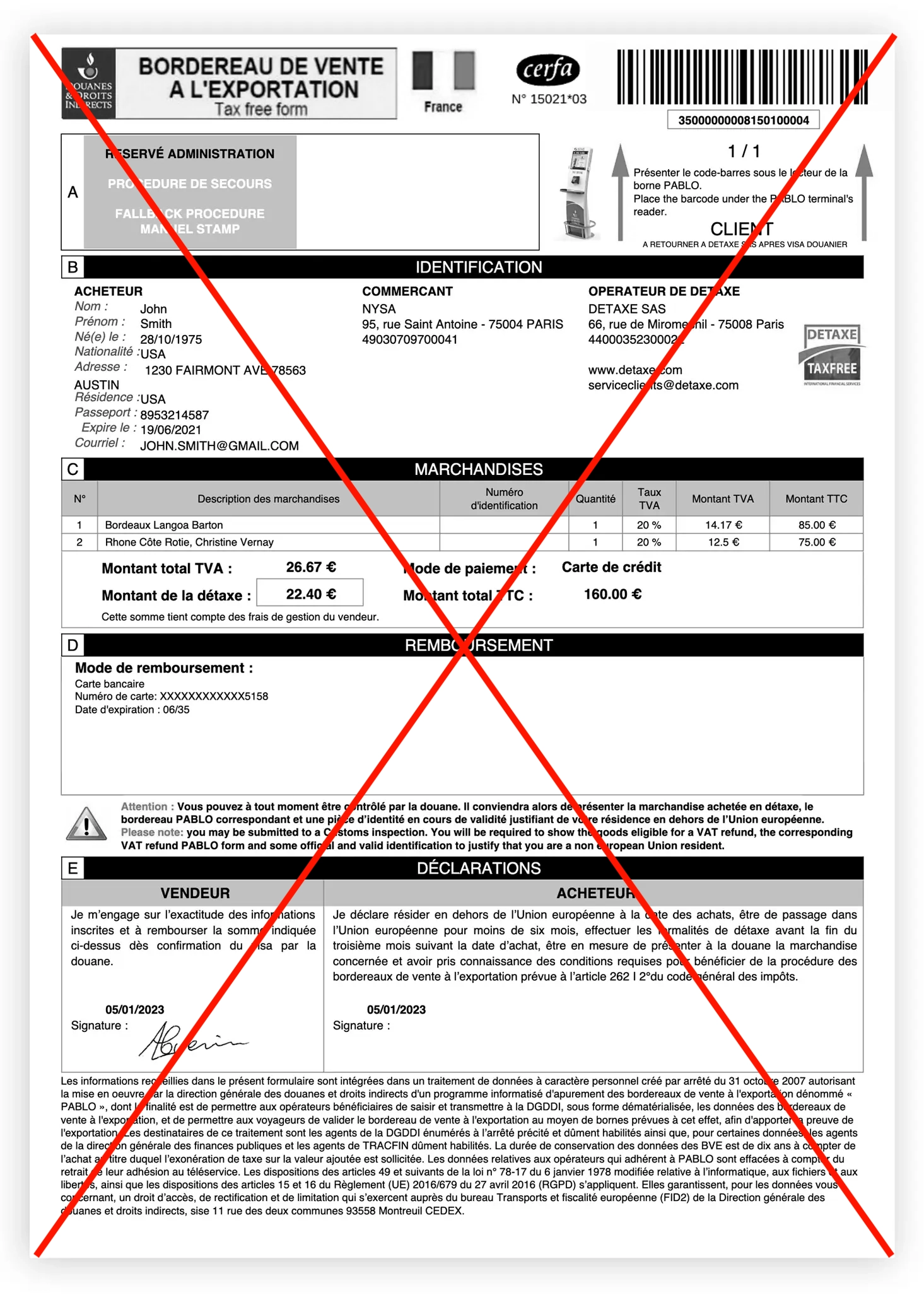

Airvat details to be included on the invoice

| in France | in Belgium | in Northern Ireland (UK) |

|---|---|---|

| Airvat EURL 10 rue de Penthièvre, 75008, Paris SIRET 90084709600014 (optional) TVA FR 50900847096 (optional) |

Airvat EURL 10 rue de Penthièvre, 75008, Paris TVA BE 1013 708 792 |

Airvat ltd 20-22 Wenlock Road London, N1 7GU England VAT no. 312092250 |

10 rue de Penthièvre,

75008, Paris

SIRET 90084709600014 (optional)

TVA FR 50900847096 (optional)

10 rue de Penthièvre,

75008, Paris

TVA BE 1013 708 792

20-22 Wenlock Road

London, N1 7GU

England

VAT no. 312092250

Good to know

- We strongly recommend asking the shop assistant for the invoice before making a purchase as they would naturally be more helpful.

- Most shops will be able to issue an invoice instantly at the checkout by entering Airvat’s company details into their cash register system.

- You do not need to justify yourself when asking for an Airvat invoice. Shops have a legal obligation to issue invoices if requested or risk getting fined by the tax authorities.

- If a merchant hasn’t heard of Airvat, that’s completely normal. We’re independent from retailers, and our French Customs licence allows us to process VAT refunds directly, helping keep fees low. Just request a business invoice made out to Airvat, and we’ll take care of the rest.

- You don’t need to show your passport to the sales assistant as you will do this instead to Airvat via the app.

![[...], [Primark], [manual], [Burberry],...VAT refund invoice for tax-free shopping in France with the Airvat tax refund app' data-feature='invoices](/blog/Airvat-app-valid-invoice.1f1bea4a.webp)