Tax Refund for Tourists

- France, Belgium, and Northern Ireland (UK)

- Fast 24 hour refund

- Lowest commission

![[...], [Primark], [manual], [Burberry],...VAT refund invoice for tax-free shopping in France with the Airvat tax refund app](https://airvat.com/Airvat-app-valid-invoice.1f1bea4a.webp)

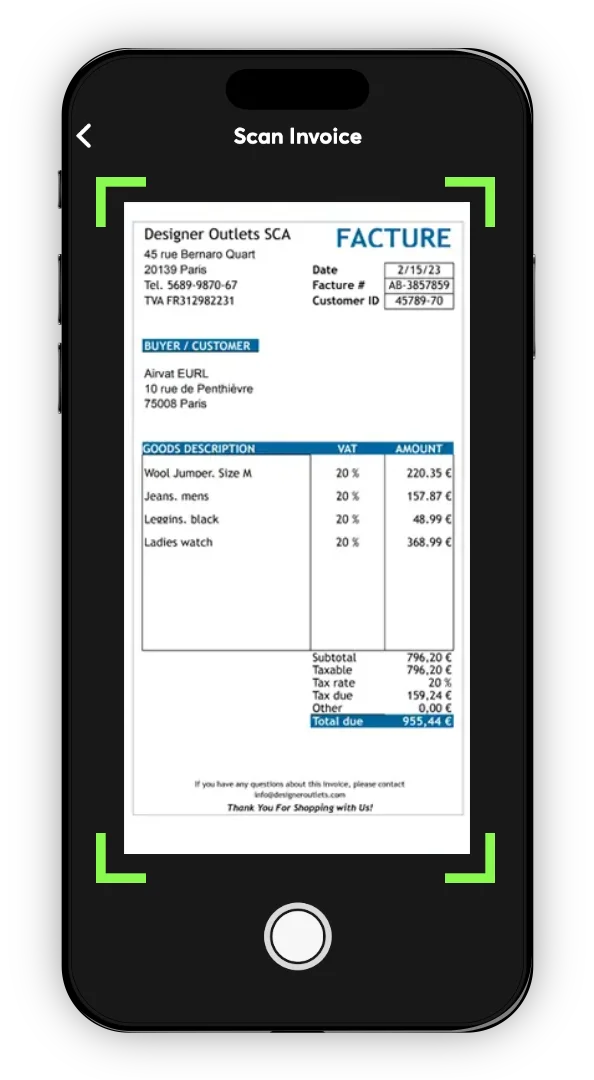

Purchase receipts or retailer’s own tax-free forms are not accepted. You must specifically request shops to issue business invoices (or “facture” in French) addressed to Airvat before making purchases. ![]() Important: read invoicing instructions.

Important: read invoicing instructions.

Take full clear pictures of your Airvat invoices each time you make a purchase in any online or physical store. We will combine all of your Airvat invoices from different stores into a single digital tax-free form.

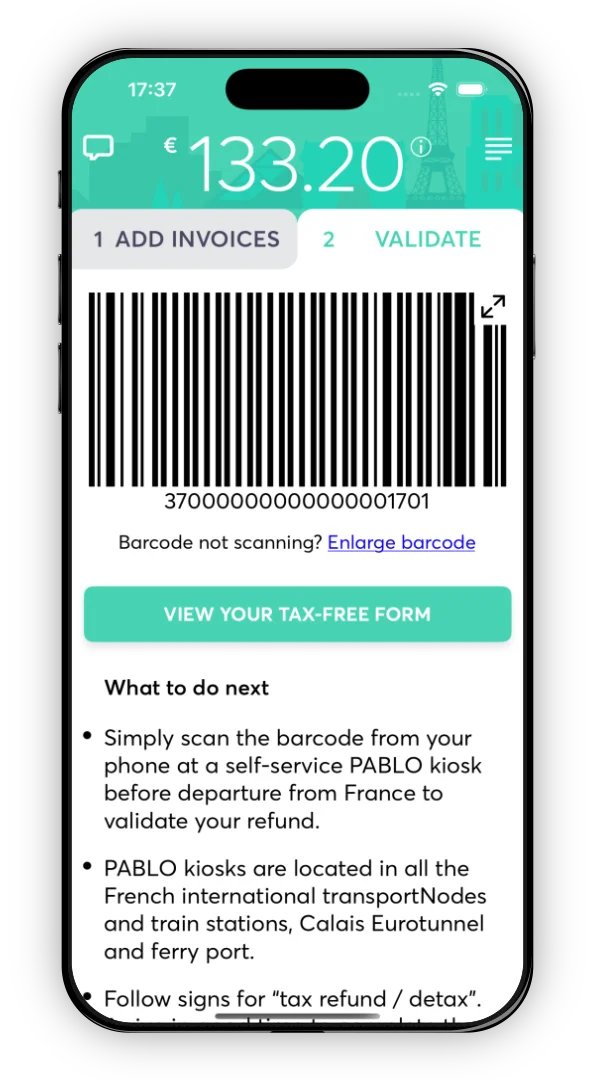

Finished shopping? Generate your Airvat tax refund form in the app before your departure. Make sure that you have all your shopping items still unused and ready for a Customs inspection.

Scan Airvat tax-free form’s barcode from your phone at any self-service Customs kiosks or see a Customs officer to digitally validate your tax free form.

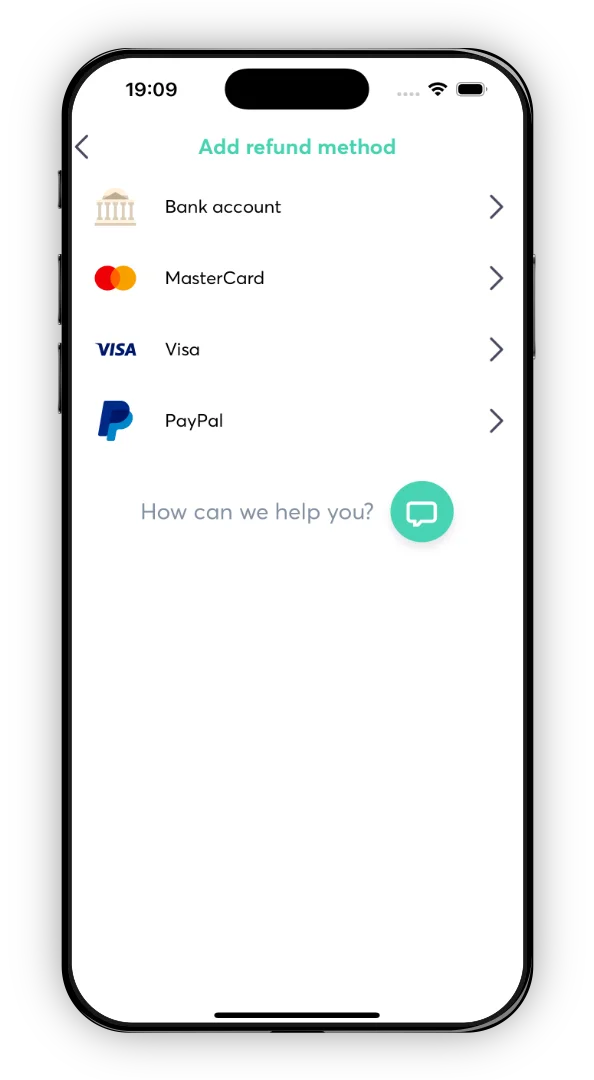

No more lost or missing refunds! Select how you wish to be paid and track the status of your refund in the app. We will never charge your card - our peace of mind guarantee!

No minimum spend, hidden fees, or foreign currency charges

Receive over 13% cash back in any online or physical store

Combine all your shopping from different stores into one refund claim