Guide to shopping tax-free in Northern Ireland

01/11/2022

Typically almost half a million of non-EU travellers come to Northern Ireland each year to enjoy the incredible countryside, historic towns, and possibly play a round of golf. Despite Brexit, visitors to Northern Ireland will still be able to take advantage of tax-free shopping during their trip.

This, however, excludes British residents (i.e. residents in England, Scotland, and Wales) who can’t shop tax-free in Northen Ireland despite being outside the EU but can instead enjoy VAT refunds on shopping in the EU, learn more here That’s right…Brexit politics can be confusing!

How does tax-free shopping scheme work

The VAT Retail Export Scheme (VAT RES), or better known as tax-free shopping, is typically managed by tax refund operators who work with retailers and Customs to process international visitors’ VAT claims.

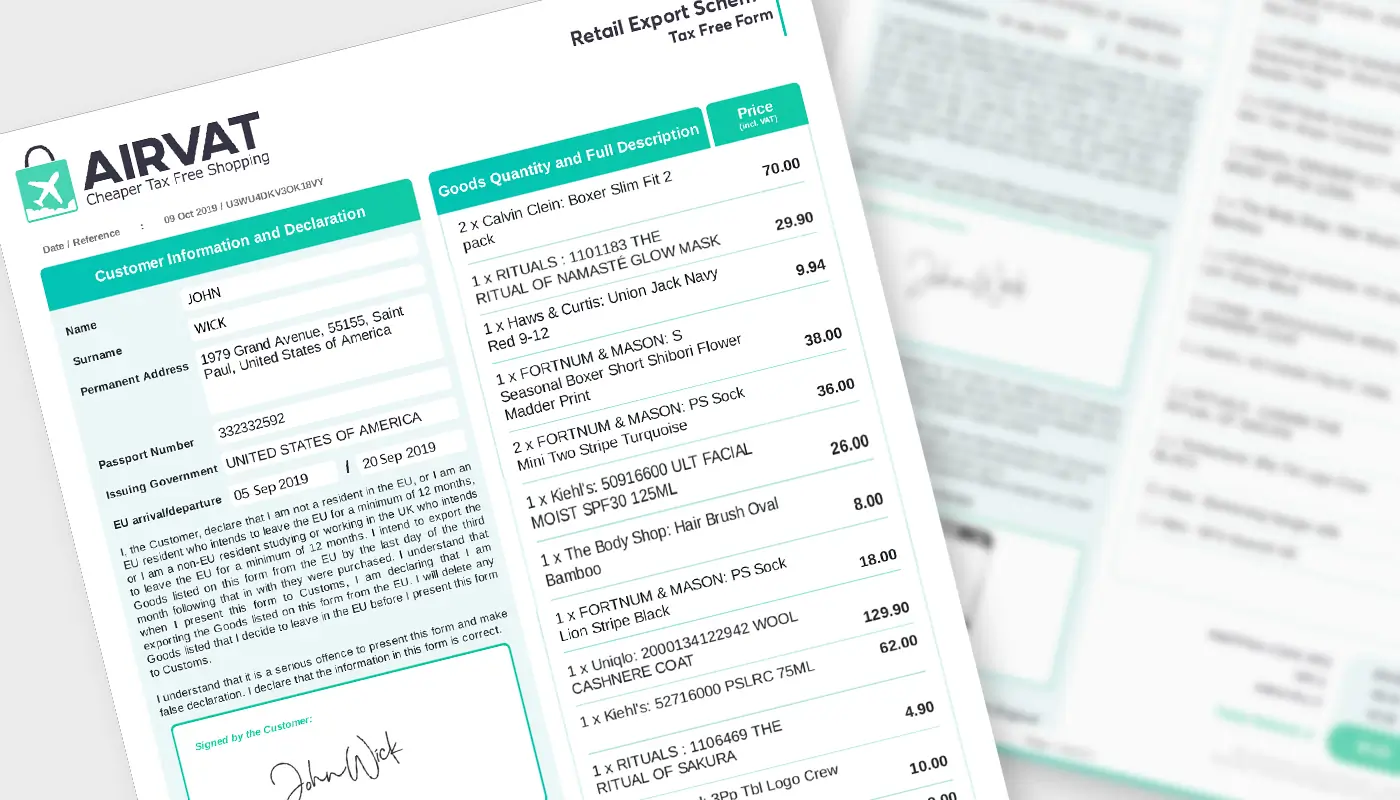

You will be issued by the retailer or a tax refund operator, such as Airvat, with a VAT refund form, officially called the VAT407 form. This form will contain a list of your tax-free purchases, amount of VAT refund, and any admin fee due to the service provider. Each tax-free form has to be authorised by Customs by the last day of the 3rd month following the month of your purchases.

Most goods sold in shops usually include 20% VAT in the price already, which can be reclaimed if you correctly follow the VAT refund procedure. There is no official minimum purchase requirement in Northern Ireland to qualify for VAT refund. Learn more here about minimum purchase requirements for tax-free shopping and how to calculate your VAT refund.

How to get a VAT refund with Airvat tax-free shopping app

Step 1

- Create an account in the app, go shopping either online or in person on the high street, and request VAT invoices in the name of Airvat from retailers stating below company details for each purchase:

Airvat ltd

20-22 Wenlock Road

London, N1 7GU

England

VAT no. 312092250

Alternatively, for purchases below £250 only, a simple till receipt is also accepted if the following information is present:

- Retailer’s name, address, and VAT number

- VAT rate and amount

- Invoice date and number

- Goods description and quantity

Upload each VAT invoice into the app as early as possible, don't leave it until the end of your trip. You can submit as many invoices as you wish and each can be of any value.

Note that the shop's own VAT refund forms or credit card receipts are not acceptable. Don’t request VAT refund forms from retailers or mention “tax-free” to avoid confusion.

Step 2

- Finished shopping and ready to fly home? Generate an electronic tax-free form in the app. You will need to print, date and sign your Airvat tax free form before presenting it to Customs at the airport.

Arrive at least 2 hours before your departure and head to the Customs or VAT refunds desk. Ensure that you have all your unused shopping ready and proceed to get a customs stamp before your departure from Northern Ireland (UK), or the EU, if Northern Ireland (UK) is not your last exit point from the EU.

If you are connecting via a UK airport, such as London Heathrow or Gatwick, you will need to have your form authorised before departing Ireland and to check in your goods as hold luggage.

Step 3

- Receive your refund payment directly on your bank account as soon as Airvat receives your original stamped tax form in our office. Ensure to pay the correct postage and send the original stamped form to us:

Airvat ltd

5 Campden House

29 Sheffield Terrace

London, W8 7NE

United Kingdom

Who is eligible for a VAT refund in Northern Ireland (NI)?

- If you come from outside the EU for a visit to NI and then return home, you can claim;

- If you live in the EU or NI, whether you are studying or working, but are planning on leaving the EU or NI for the next 12 months, you can also claim.

Even though England, Scotland, and Wales (i.e. Great Britain) are not part of the EU any longer, permanent GB residents are not entitled to a VAT refund in NI

You will need to provide sufficient proof of your eligibility to customs officers. Usually your non-EU passport should be sufficient. Although in cases where you hold an EU/UK passport but live permanently outside the EU/NI/UK, you will need to provide additional evidence of your permanent residency. Usually any valid non-EU visa/work permits, or formal employment/university letters would be enough.

It is up to you to demonstrate to a Border Force officer that you are a non-EU resident so make sure to bring along enough evidence in cases where your personal circumstances are not straight forward.

What can be purchased tax-free

You can only claim VAT refunds on purchases that you make online or in-store. Tax-free goods must be carried in your personal luggage so you won’t be able to buy heavy or bulky items in NI and have them shipped to your home as freight. Typically tax-free purchases include goods such as jewellery, cosmetics, watches, clothes, portable electronics, and souvenirs.

A simple rule to remember is that if you cannot put something in your personal luggage to be carried to your home country, it is not eligible for tax-free shopping. Therefore, services like restaurant meals, tickets, hotel accommodation, can’t be exported and consumed in your home country so are not eligible for a VAT refund.

Also an important exemption are books and children’s clothes, which are not subject to tax in the first place, hence, there is nothing to refund.

How to get your VAT refund form authorised

You will need to have your tax refund form stamped by Customs before departure from Northern Ireland (UK). Alternatively, if your trip continues on to another EU country after visiting Northern Ireland, you will need to get a Customs stamp at your final exit point from the EU. For example, if you are leaving Northern Ireland from Dublin Airport, the Dublin Airport customs will stamp your VAT refund form.

Remember “No stamp, no refund!” and you will not be able to get your form stamped retrospectively or when you arrive home.

If Customs request to see your tax-free purchases, they must be presented unused and in their original packaging (half empty perfume bottles or eaten chocolates will not pass the inspection!).

A final word of warning is that you should not attempt to mislead customs as it may result in your goods being taken away or you being held up at the border causing you to miss your flight.