Online shopping tax free with the Airvat app

29/03/2023

Do you pay VAT on online purchases

Yes, just like with shopping in physical stores, online retailers in Europe add VAT on goods delivered to an address within the EU.

Does tax free work online

Yes! You can even buy online ahead of your trip and have the goods delivered to your hotel, friends and family, or retailer’s store (i.e. click and collect service).

How to get a VAT refund on online purchases

-

Get an invoice in the name of Airvat by inserting below details in the “billing section” at the time of making your online order.

in France in Belgium in Northern Ireland (UK) Airvat EURL

10 rue de Penthièvre,

75008, Paris

SIRET 90084709600014 (optional)

TVA FR 50900847096 (optional)Airvat EURL

10 rue de Penthièvre,

75008, Paris

TVA BE 1013 708 792Airvat ltd

20-22 Wenlock Road

London, N1 7GU

England

VAT no. 312092250Airvat EURL

10 rue de Penthièvre,

75008, Paris

SIRET 90084709600014 (optional)

TVA FR 50900847096 (optional)Airvat EURL

10 rue de Penthièvre,

75008, Paris

TVA BE 1013 708 792Airvat ltd

20-22 Wenlock Road

London, N1 7GU

England

VAT no. 312092250 - Have the purchases delivered to your own specified shipping address in France or Northern Ireland (UK) only. Don’t mistakenly include Airvat’s details for delivery as we would not be able to handle the parcel for you!

- Upload the invoices into the Airvat app and follow the instructions to generate your tax-free form.

- Pack the online shopping in your personal luggage and have your tax-free form validated by customs before departure from the EU.

- Wait for your VAT refund payment.

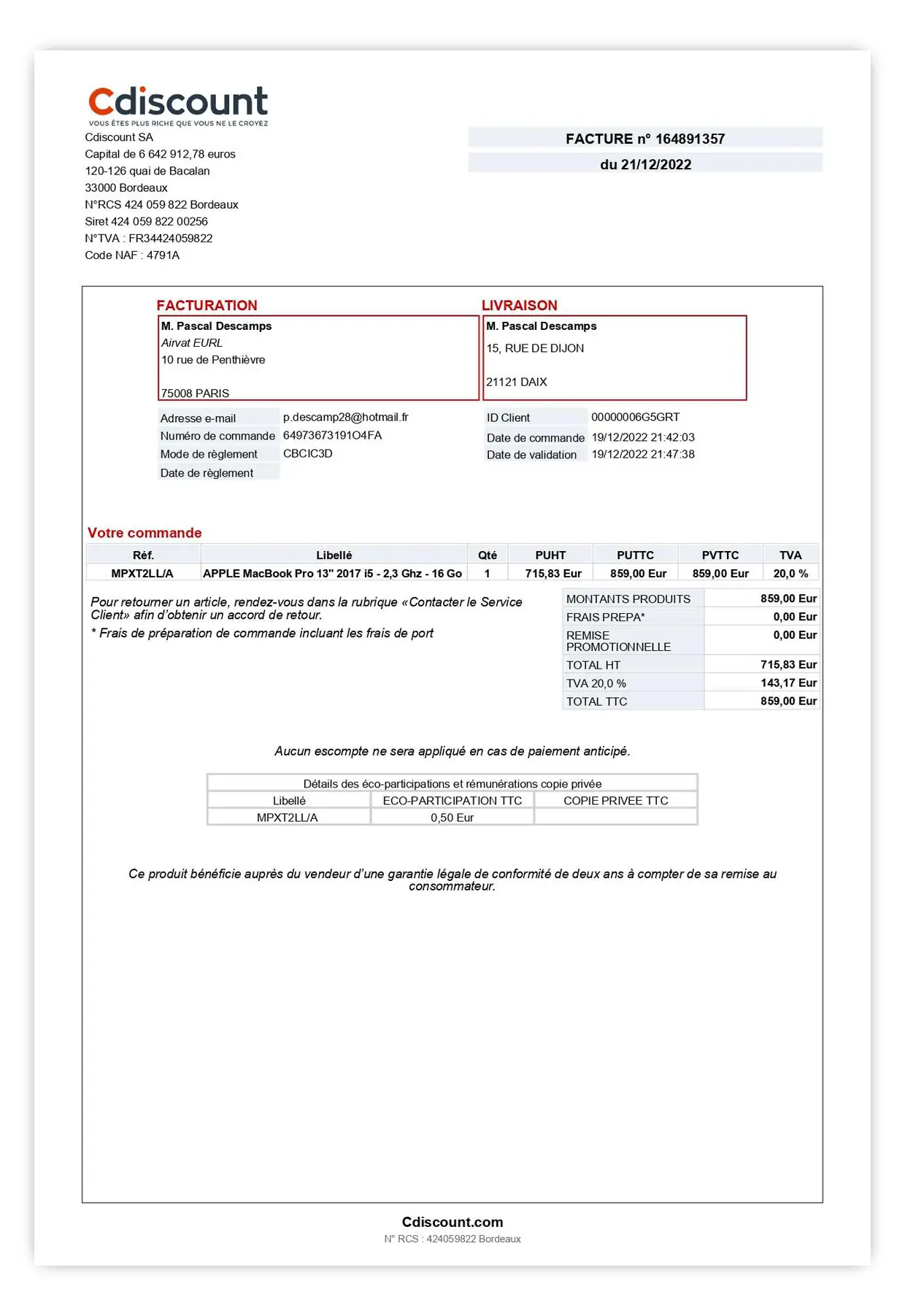

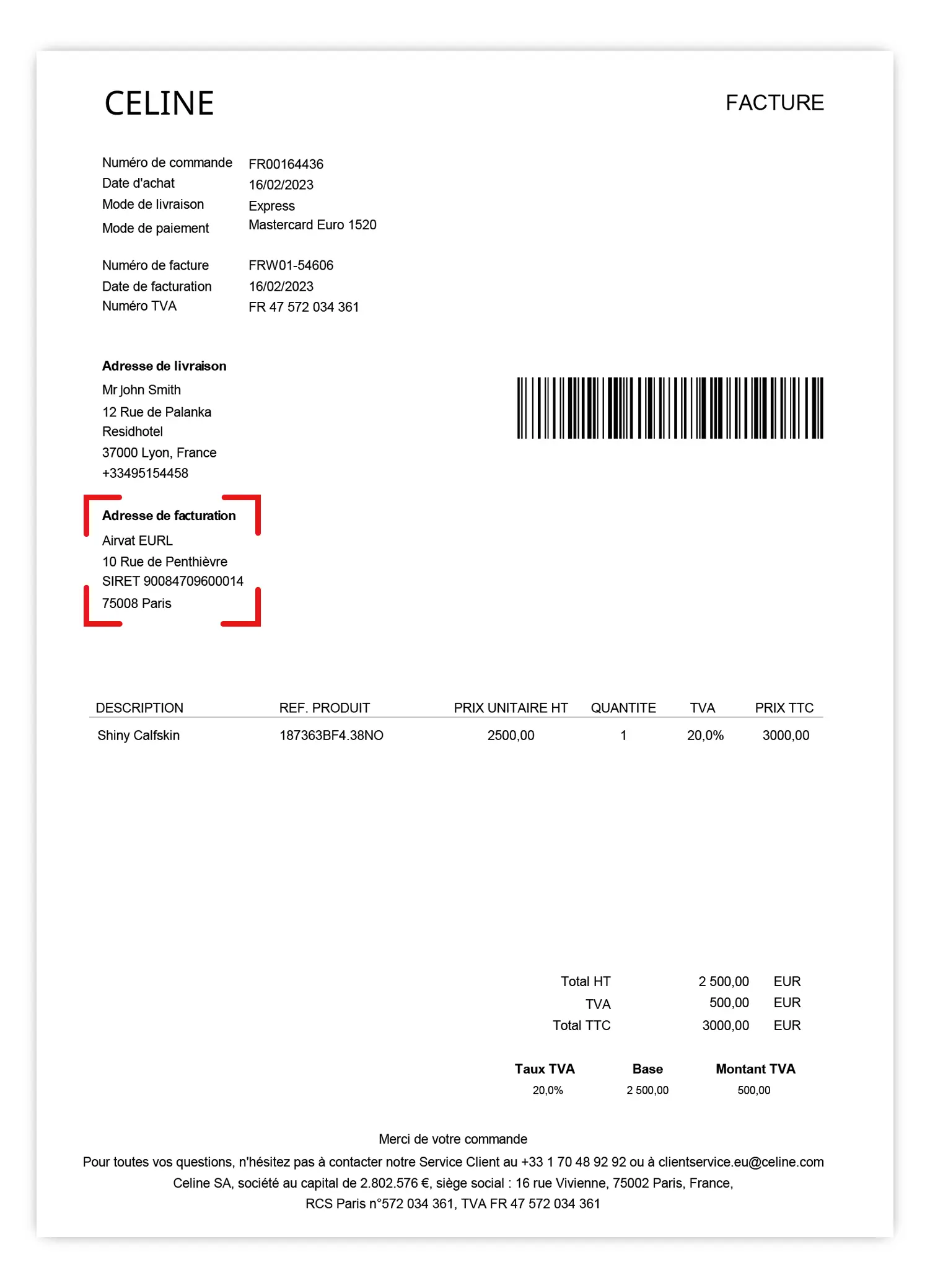

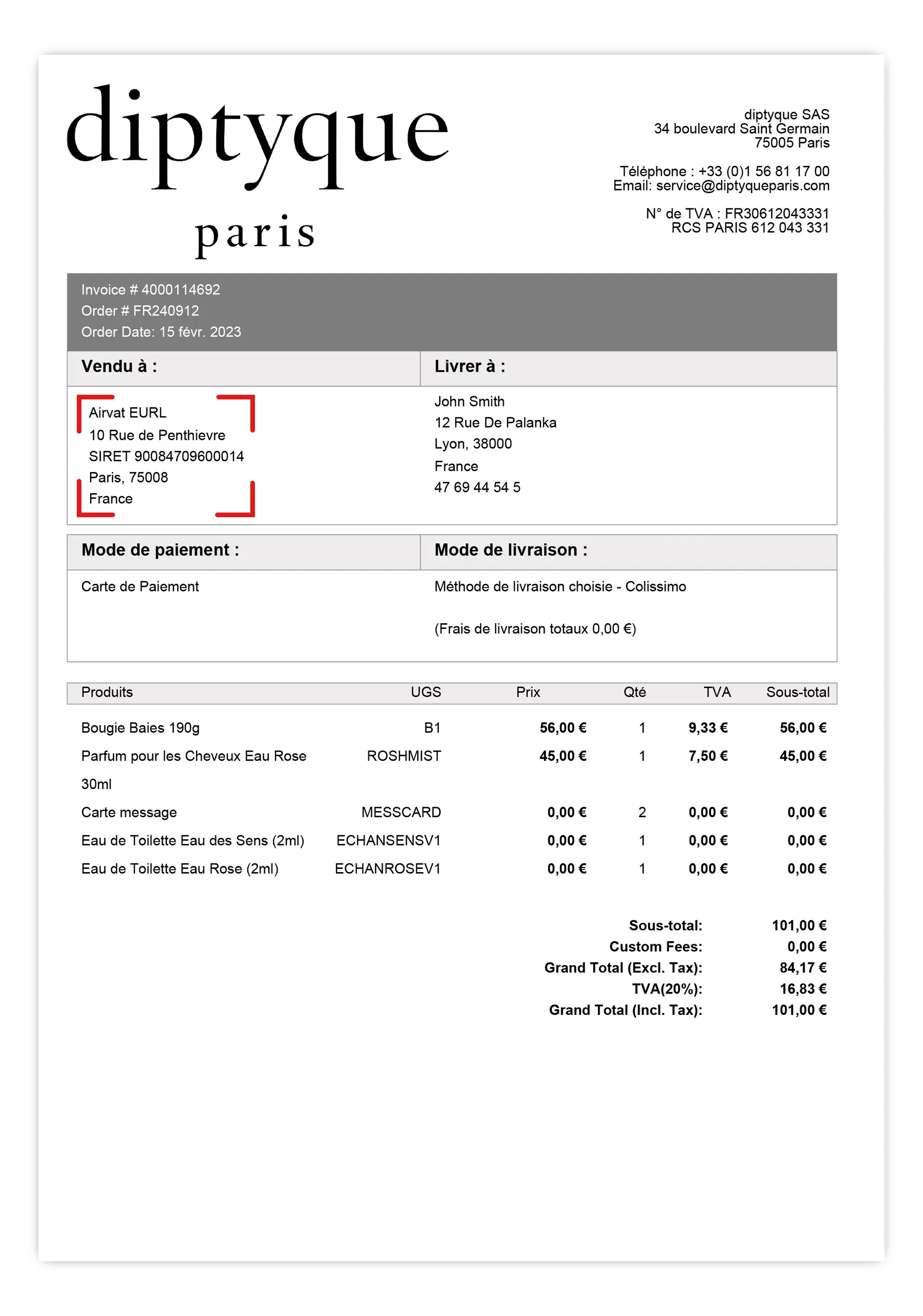

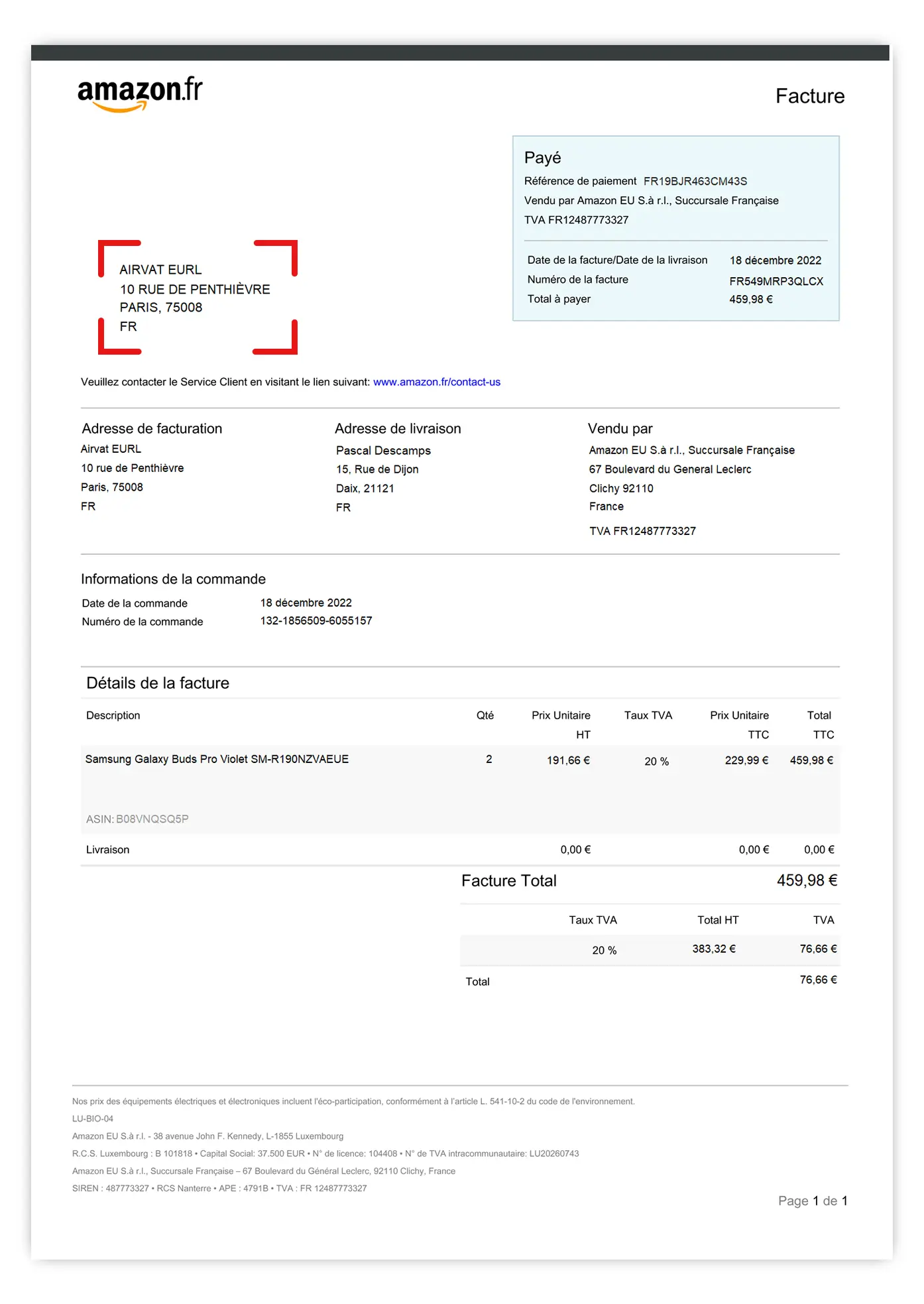

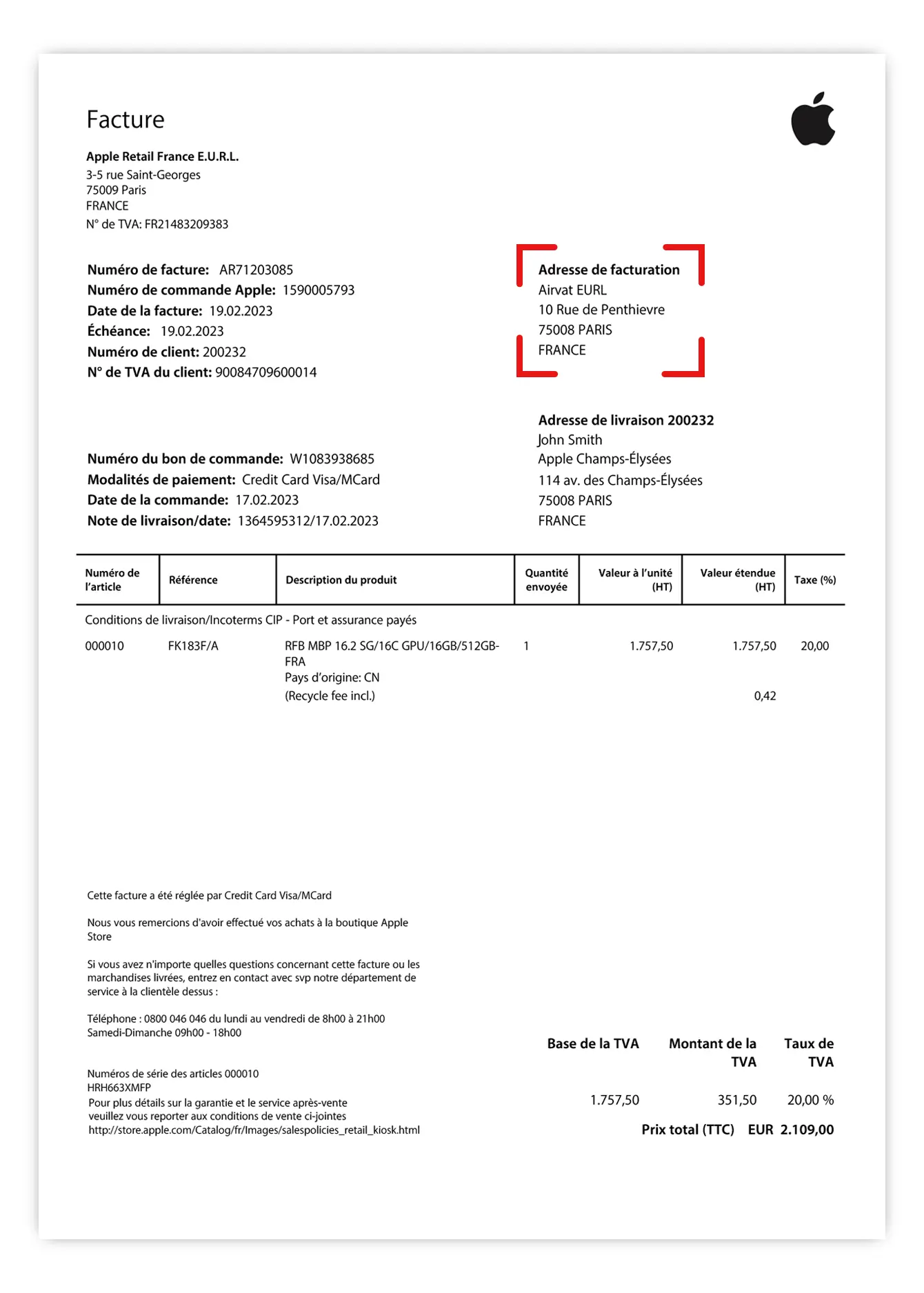

Examples of valid invoices in the name of Airvat ✅

You must specifically get the invoice to state Airvat’s company details in the “billing section”. Read this article on valid VAT invoice.

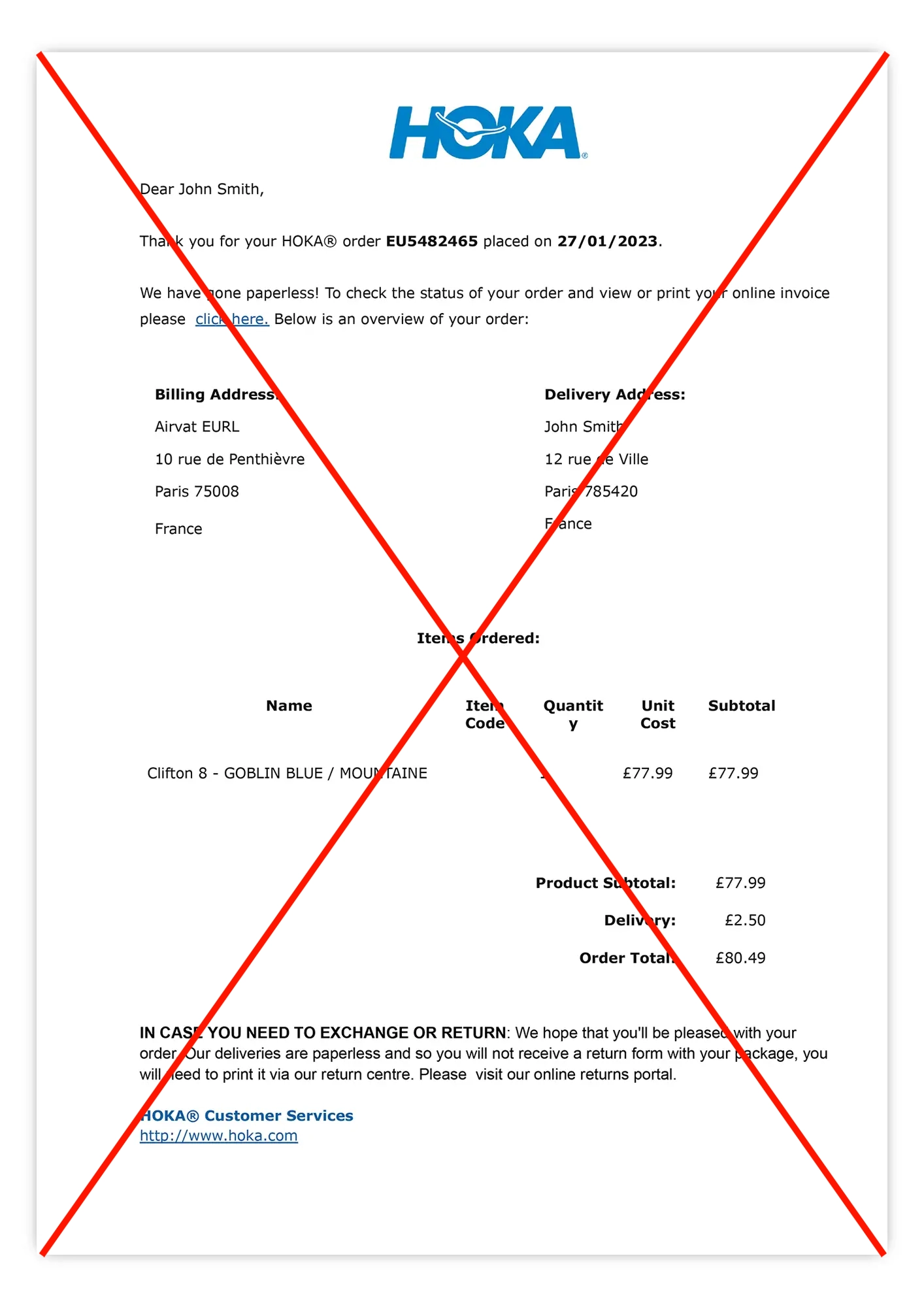

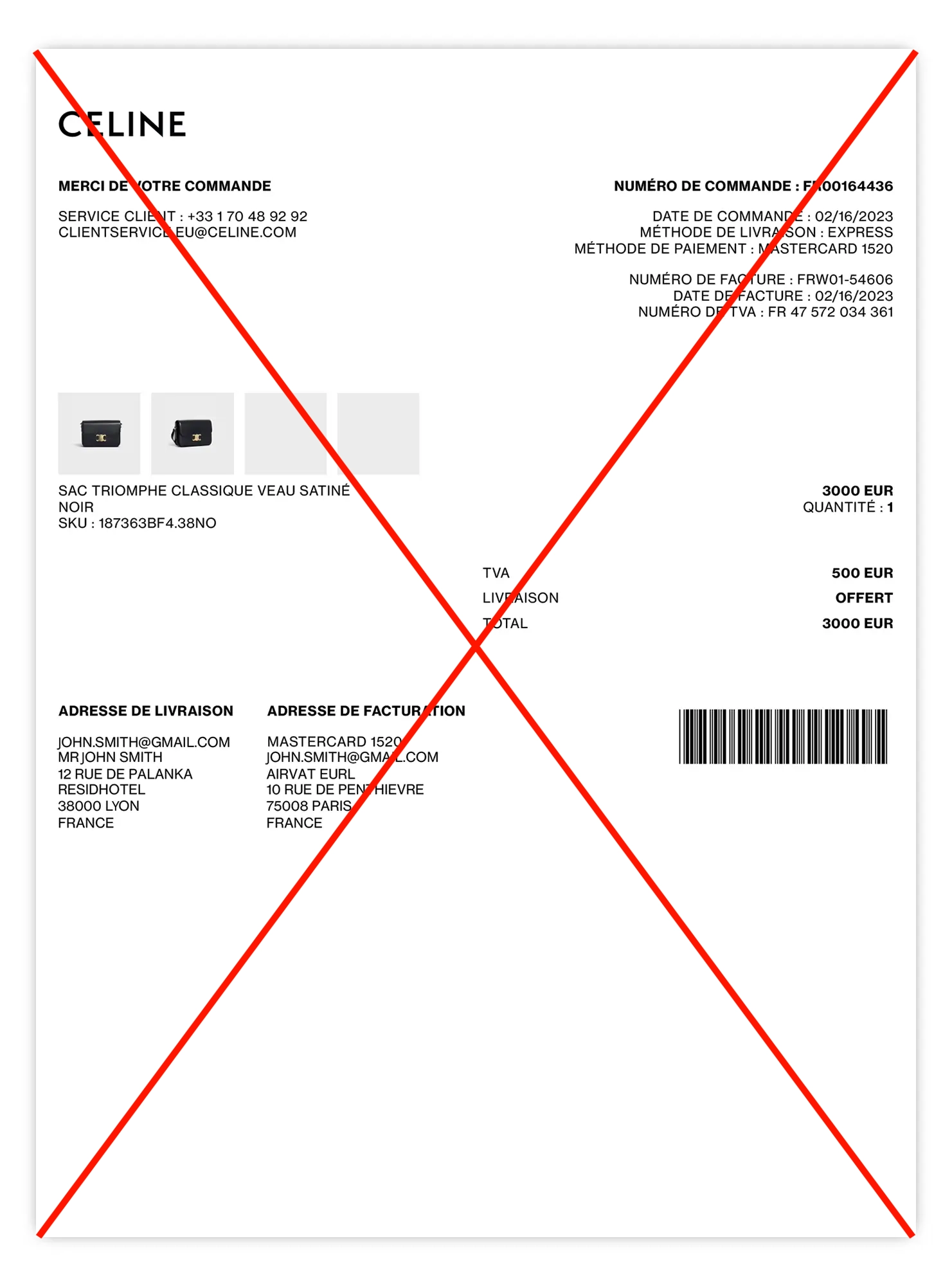

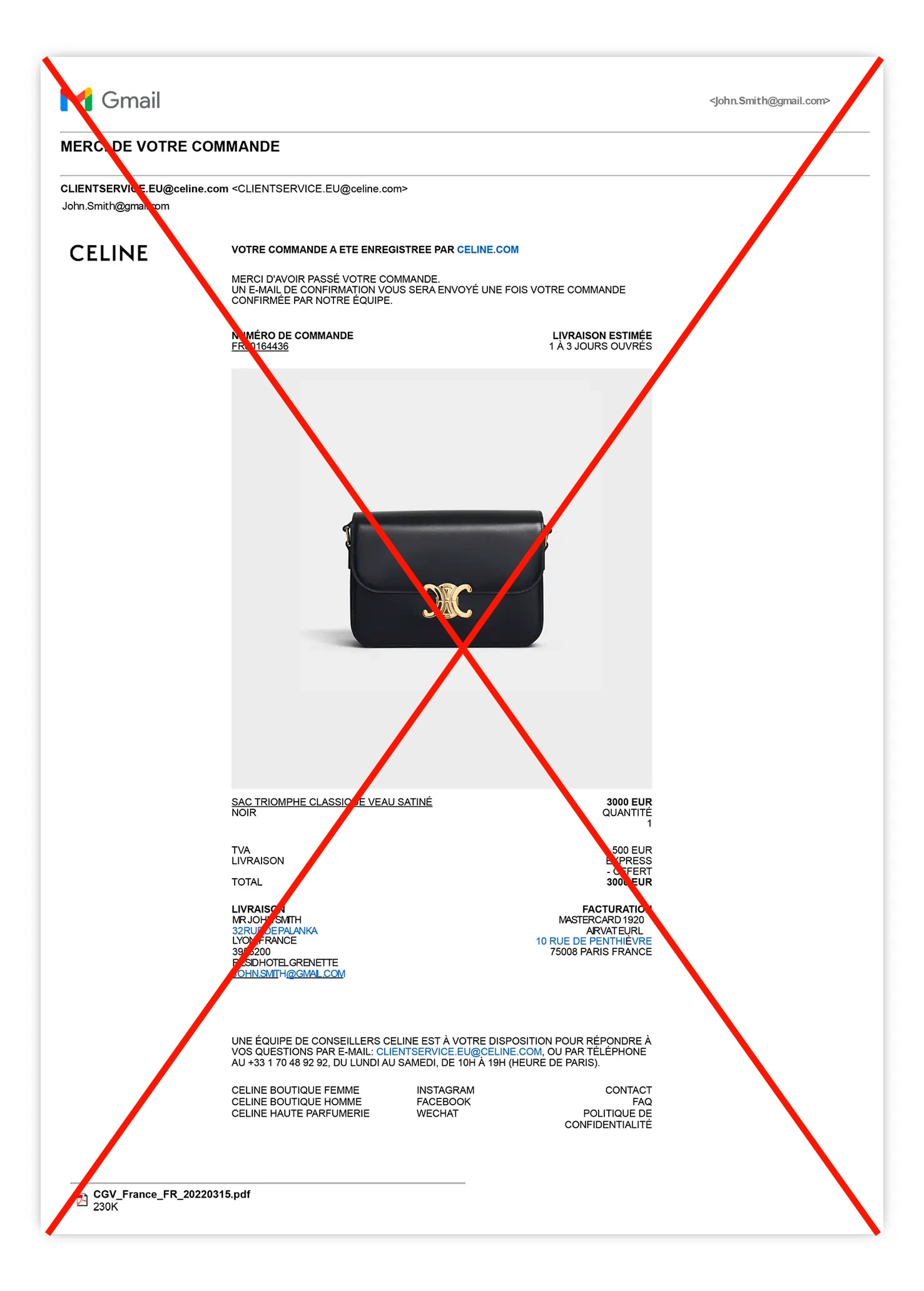

Examples of invalid invoices for VAT refund online shopping ❌

Purchase order emails or delivery confirmations are not acceptable to process your VAT refund.

How to get VAT refund online purchase invoice in the name of Airvat

- Typically e-commerce websites, such as Amazon, allow users to pre-register multiple addresses in the customer profile section. If this is the case, set up a new address with Airvat’s details and select it as the “billing address” at the checkout.

- If there is no option to pre-register multiple addresses, you would normally be given two address sections during the checkout process: one for “delivery/shipping”, and another one for “invoicing/billing”; just specify Airvat’s details in the billing section.

- Occasionally, there might be no option to specify a separate billing address. In this case, do your best to include Airvat’s name (and if possible registration numbers) among your personal delivery details or in a spare address line.

- You can also try to request the retailer's customer support service to issue an invoice as per your instructions.

Important for tax free online shopping

The online retailer must be registered for VAT in France or Northern Ireland (UK), i.e. the country where you wish your goods to be delivered.

Good news is that if the retailer has physical stores in France or Northern Ireland, they will likely issue local VAT invoices for their online sales as well.

If in doubt, you can also do a quick online search. For example, to check if a retailer has a French VAT registration, search “retailer’s name, France TVA” and look for a VAT (or TVA in French) number starting with “FR”, or details of the retailer's French company/subsidiary incorporation.

Sometimes, e-commerce retailers can be registered for the “VAT one-stop-shop” (also known as OSS) in the EU - this is also acceptable.