Guide to shopping tax-free in France

07/06/2023

All non-EU visitors to France, which now also includes British citizens, can benefit from VAT free shopping in France by claiming 20% tax back. There is no better place to treat yourself to bargains than in the global capital of high fashion - Paris!

How does the tourist tax refund scheme work

There are two ways to claim a tourist tax refund in France. You must decide which method to use for each purchase before making a payment so that you request the correct paperwork from the sales assistant.

Your can either get a tax refund:

1) via the shop where you made your tax-free purchase. After showing your passport, you will receive the shop’s VAT refund form. However, expect to pay a high commission!

or,

2) directly from a licenced tax-free operator, such as Airvat, in which case don't show your passport to the sales assistant but instead ask for a business invoice addressed to Airvat. Benefit from a low commission service!

Method 1. VAT refund via the store where you made the purchase

Stores that offer VAT refunds usually do so with the help of a partner tax-free operator. The sales assistant would issue a VAT refund form of the store’s chosen agent if you show them your passport at the checkout.

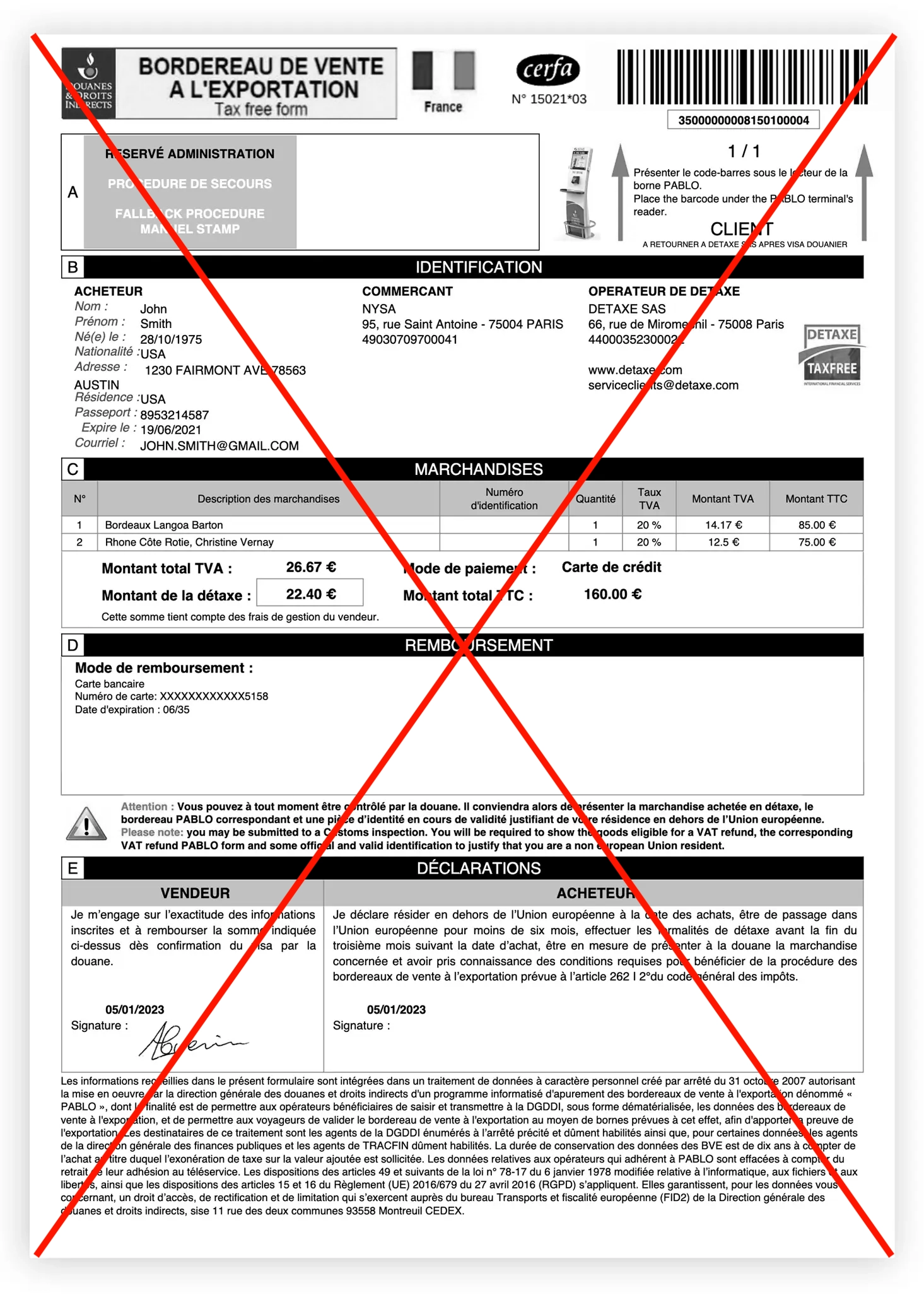

Each tax-free form, or officially known as “Bordereau de vente à l'exportation” in French, will have the name and logo of the tax-free operator that issued the document, which is the company that would make the refund payment to you.

Because both the shop and their partner tax refund operator earn a commission from your purchase, expect to receive 30-50% less VAT back after numerous deductions, which are not always disclosed.

As different shops have different VAT refund partners, you will likely end up with multiple tax refund forms. You would need to follow each operator’s instructions of how to validate your tax claim and receive your VAT refund. So it can get a little bit confusing, especially if you have to look out for multiple payments after your trip.

Example of a tax-free form issued by a store selling tax-free goods

Method 2. VAT refund with a tax-free app

In the past few years the French customs authorities have licensed a number of tax-free app operators, such as Airvat, to improve the service.

Because app based refund operators are usually not affiliated with any retailers, they are able to charge a much lower commission. In the case of Airvat, it is a transparent 20% fee without any hidden charges, which means you will get just over 13% cash back on each tax-free purchase. A typical Airvat customer on average receives double the refund amount relative to using the shop’s own tax refund service.

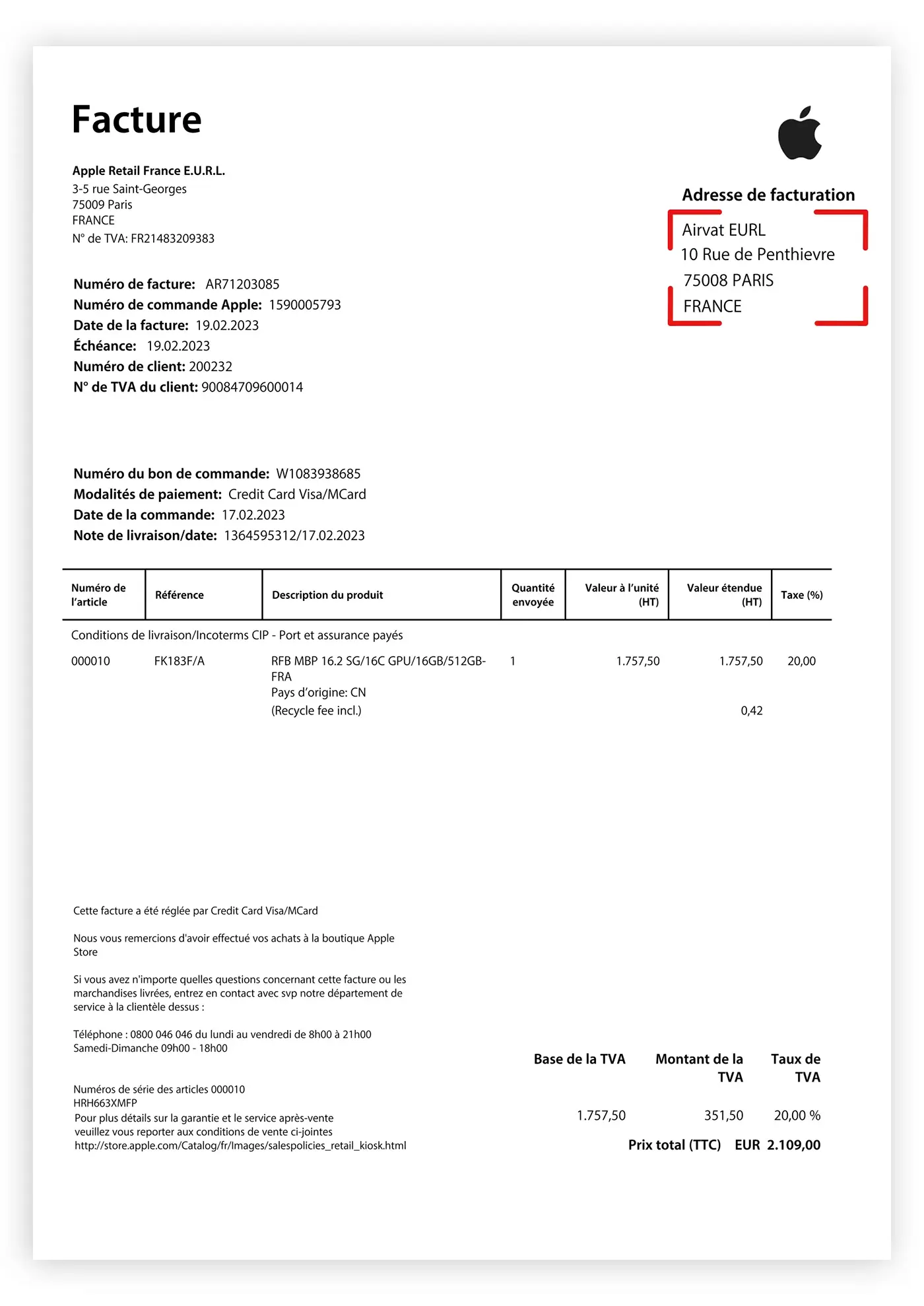

If you choose to use Airvat for your tax-free shopping, best not to mention tax-free or show your passport to the sales assistant to avoid confusion and ending up with the shop’s own VAT refund form. Instead, you must request a business invoice addressed to Airvat.

Using a VAT refund app service allows you to consolidate all your purchases from different retailers into a single tax refund form. The Airvat app will automatically generate its own tax-free form containing all your purchases from different stores at the end of your shopping trip. You will need to validate just this one VAT refund form up on departure and avoid the confusion of dealing with multiple operators and procedures.

VAT refund apps also work the same way for online shopping. You can even shop online before your trip and have the goods delivered to your friends or hotel. With so many online retailers offering next day free delivery or “click and collect” service, why not take advantage of this shopping option!

Example of an Apple tax-free invoice addressed to Airvat

VAT refund minimum purchase

Each individual purchase has to be over €100 to qualify for a VAT refund if you claim tax back via the shop where you made the purchase.

However, another significant advantage of using tax refund apps, like Airvat, is that your individual purchases from different stores can be of any value as long as the total sum of all your tax-free goods exceeds €100.

What items can I buy tax-free in France

Your shopping has to be for personal use and carried home in your luggage within 3 months of purchase.

Most popular tax-free purchases typically include goods such as fashion accessories, handbags, jewellery, cosmetics, watches, clothes, portable electronics, and souvenirs.

Your tax-free shopping goods must be unused, still in their original packaging, and available for Customs inspection when you are leaving from France or the EU.

Tax-free airport procedure and Pablo kiosks

Arrive early at your departure point and follow the signs for Customs or VAT refunds (“Detax” in French), to find self-service PABLO kiosks. All French international airports and the main train stations would have Pablo detax terminals, including Gare du Nord Eurostar train and Calais Eurotunnel terminal (official list of Pablo kiosk locations).

Pablo tax refund machine at Gare du Nord Eurostar terminal in Paris

You must validate each VAT refund form before checking in your luggage. Simply scan the barcode at the top right corner of your tax-free form at a Pablo detax kiosk. If you chose Airvat app for your VAT refund, you will be able to scan the tax-free form’s barcode directly from the screen of your smartphone.

Most of the time you will see a green tick on the Pablo detax screen confirming that your tax-form has been validated electronically. Occasionally, especially in the case of high value items, you may be requested to see a customs officer to have your documents and goods inspected before your refund can be authorised.

Electronic Pablo tax refund customs validation in France

France is not my last departure point from the EU

If France is not your final exit point from the EU, or you are not departing from one of the main international airports or rail stations in France (such as some road border crossings), you will need to get a manual customs stamp on a printed paper copy of the tax-free form since there will be no Pablo detax kiosk to scan the barcode.

- For the shop's own tax-free forms, follow the instructions of the VAT refund operator who issued the document. Often this involves dropping the original document into a letter box at the airport or posting it to the agent.

- For Airvat issued VAT refund forms, simply upload the image of the stamped original form into the app (although for high value forms, we may ask you to post the original to us).

Tax-free refund payment and tax refund at the airport

The refund will be paid to the credit card or bank account that you specified at the time of purchase in the store, or inside the Airvat app if you used our service.

You will usually be able to get an immediate cash VAT refund at the airport after validating the tax-free form. However, watch out for the extra fees and poor currency exchange rates, which can reduce the refund amount by an extra 10-20%.

Often there is also an option to get an advance payment of the refund amount for an additional fee before your departure date. However, beware that you still need to follow the standard procedure to validate your tax-free at the airport on the departure day, or this amount plus a penalty will be charged back to your credit card.

Given the extra fees, we don’t recommend getting an advance of your VAT amount before departure or cash tax-free at the airport, which is why Airvat does not offer such services. Instead, your Airvat refund amount payment will be made directly to your specified account within a week after validating the tax-free form, without any unexpected deductions or exchange rate mark-ups.

What is the VAT refund in France

France's standard VAT rate, or “TVA” in French, is 20%. However, you will not be able to get all of this tax back as retailers or authorised VAT refund operators charge a commission when processing your claim. The actual refund amount that you will receive with Airvat is just over 13% of the goods’ price.

Always be sure to look into the provider’s small print to understand exactly how much of the tax-free refund you will receive. Read this article about how to calculate VAT refund in France.

Happy tax-free shopping!